Introduction to Trading View: Its Features and Benefits

In today’s fast-paced financial markets, having access to real-time data, advanced analysis tools, and a vibrant trader community can significantly enhance your trading success. One platform that stands out in this domain is trading view. Renowned for its comprehensive charting features, social integration, and user-friendly interface, Trading View has become a preferred choice for both novice traders and seasoned investors. This article delves into the core features, practical functionalities, and strategic advantages of using Trading View, empowering you to leverage its capabilities for improved market analysis and trading performance.

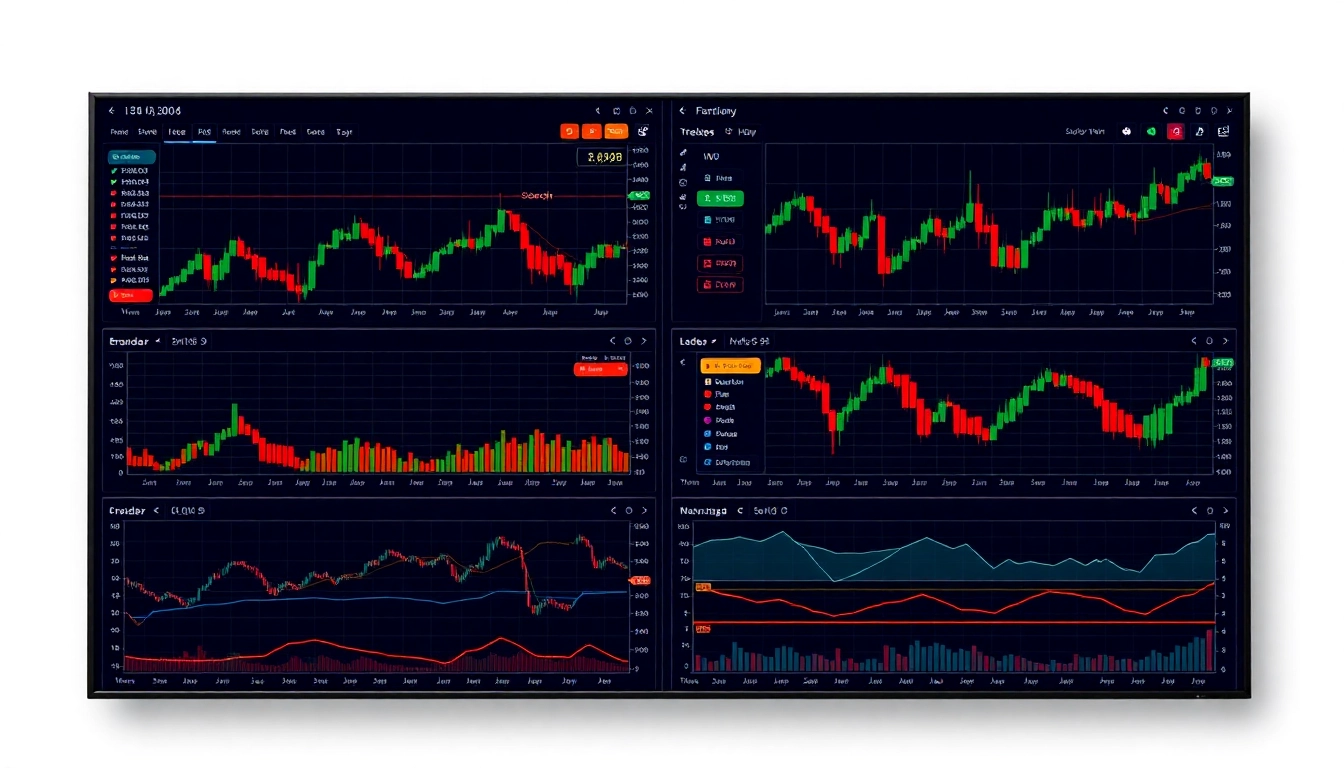

Understanding the Trading View Interface

At the heart of Trading View’s popularity is its intuitive and customizable interface. When users log in, they are greeted with a dynamic dashboard that consolidates multiple tools and charts in a clean layout. The main workspace displays a real-time price chart, which can be tailored according to preferences—ranging from candlestick, bar, line, to Heikin Ashi charts. Navigation is straightforward with a collapsible sidebar containing instrument searches, watchlists, alert settings, and drawing tools.

Key to the platform’s usability is its flexible layout, allowing traders to set up multiple charts, indicators, and analysis windows simultaneously. Each chart includes a timeline at the bottom, enabling detailed time-based analysis. Top menu options provide quick access to features like timeframes (from 1-minute to monthly), comparison tools, and the ability to toggle between different asset classes such as stocks, cryptocurrencies, forex, and commodities.

The interface also integrates social features seamlessly. Users can publish ideas, comment on others’ analyses, and participate in discussions—all within the same environment. This connectivity provides invaluable insights, fostering collaborative learning and shared market perspectives.

Key Tools and Indicators for Effective Trading

Trading View offers an extensive library of technical analysis tools. Popular indicators include Moving Averages (MA), Relative Strength Index (RSI), Bollinger Bands, MACD, Fibonacci retracements, and volume-based tools. These indicators help traders identify potential entry and exit points, trend strength, and market momentum.

Beyond standard indicators, Trading View supports custom scripts created in Pine Script, its proprietary programming language. This allows traders to develop and implement personalized indicators and trading strategies, enabling highly tailored analysis. Additionally, the platform provides pattern recognition tools such as head-and-shoulders, double tops/bottoms, and trendlines, which are essential for technical pattern trading.

Trading View’s alert system is highly customizable. Traders can set alerts based on price levels, indicator crossovers, or pattern formations. Alerts are delivered via pop-up notifications, email, or SMS, ensuring traders stay informed even when away from their screens. This real-time alerting system is crucial for responding swiftly to market movements.

Advantages of Using Trading View for Market Analysis

Trading View’s multifaceted approach to market analysis offers several notable benefits:

- Unified Platform: Seamlessly combines charting, social features, and trading tools in one interface.

- Accessibility: Cloud-based and compatible across devices—desktop, tablet, and mobile apps ensure trading on the go.

- Community Insights: Access to a vast community generates trading ideas, forecasts, and discussion threads, facilitating knowledge sharing.

- Customization: Highly customizable environment allows users to tailor layouts, indicators, and alerts to fit their trading style.

- Integration: Supports integration with various brokerage accounts, enabling direct trading from charts, streamlining execution processes.

This integrated ecosystem simplifies the complexities of market analysis, making informed trading decisions more accessible for traders at all experience levels.

How to Maximize Trading View for Successful Trading

Setting Up Custom Watchlists and Alerts

Effective trading begins with organized tools. Start by creating watchlists tailored to your preferred asset classes, sectors, or trading strategies. Trading View allows multiple watchlists, making it easy to monitor specific groups of stocks, cryptocurrencies, or forex pairs.

Alerts should be set strategically during setup—whether for crossing certain price points or indicator signals. Maintaining a systematic alert configuration ensures you don’t miss critical movements and can act promptly.

Utilizing Drawing Tools and Technical Indicators

Leverage Trading View’s extensive drawing tools—trendlines, channels, Fibonacci retracements, and pattern tools—to visually analyze potential support/resistance zones and trend channels. Incorporate multiple indicators to confirm setups; for example, combining RSI divergence with trendline analysis can strengthen trade signals.

Practicing consistent drawing techniques and aligning multiple indicators provides a robust foundation for your trading decisions, reducing emotional bias and increasing accuracy.

Integrating Trading View with Your Trading Strategies

To maximize utility, synchronize your Trading View analysis with your overall trading plan. Use the platform’s backtesting features to evaluate the performance of your strategies historically. Export and track your analysis to identify recurring patterns and refine your approach.

Additionally, embedding social insights and community ideas into your workflow can introduce new perspectives and validation points, supporting more disciplined trading behaviors.

Advanced Techniques in Trading View

Backtesting Strategies Using Trading View Charts

Backtesting involves applying your strategy onto historical data to measure its effectiveness. Trading View facilitates this through its Pine Script environment, allowing traders to create custom scripts for automatic strategy testing. By reviewing past performance metrics such as win rate, average profit/loss, and drawdowns, traders can optimize their approach before risking real capital.

Using Multiple Timeframes for Precise Entries and Exits

Analyzing markets across multiple timeframes—such as daily, hourly, and 15-minute charts—provides a comprehensive view of trend and momentum dynamics. For example, a trader might identify a long-term bullish trend on the daily chart but wait for a bullish reversal on the 15-minute chart before entering. This layered approach enhances timing precision and risk management.

Leveraging Social Features for Market Insights

Engaging with Trading View’s community enhances market understanding. By following experienced traders, reviewing publicly shared ideas, and participating in discussions, traders gain diverse insights and forecasts that might not be immediately evident through pure technical analysis. This social engagement fosters continuous learning and perspective diversification.

Case Studies: Successful Traders Using Trading View

Real-Life Examples of Profitable Strategies

Many successful traders attribute their consistent gains to the strategic use of Trading View. For example, a forex trader might leverage Fibonacci extensions combined with RSI divergences to pinpoint entry points during trend retracements. Meanwhile, a cryptocurrency trader might rely on volume spikes and breakout patterns identified through Trading View’s charting tools.

Lessons Learned from Top Traders

Insights from top traders reinforce key practices: Use multiple indicators for confirmation, stick to well-defined trading plans, and stay disciplined with stop-loss orders. Learning from informative community threads and analysis shared on Trading View accelerates skill development and helps avoid common pitfalls such as overtrading or impulsive decisions.

Applying Best Practices to Your Trading Workflow

Integrate Trading View into your daily routine by scheduling regular review sessions, keeping detailed trade logs, and continuously refining your strategies based on performance data. Combining technical analysis, social insights, and disciplined execution creates a resilient trading workflow.

Performance Metrics and Tools to Track Your Progress

Analyzing Your Trading Performance with Trading View

Trading View’s charts and scripting tools allow comprehensive performance tracking. Use the platform to monitor key metrics such as win rate, average profit/loss, and risk-reward ratios. Overlay these metrics with your trade entries and exits for full transparency.

Adjusting Strategies Based on Data Insights

Data-driven adjustments improve overall profitability. For instance, if analysis reveals frequent false breakouts at certain levels, consider tightening stop-loss levels or confirming signals with additional indicators before entry.

Continuous Learning and Market Adaptation

The markets are continuously evolving; hence, adaptive strategies are essential. Use Trading View’s ongoing feature updates, community insights, and your own analysis data to stay ahead of trends and adapt your tactics accordingly.